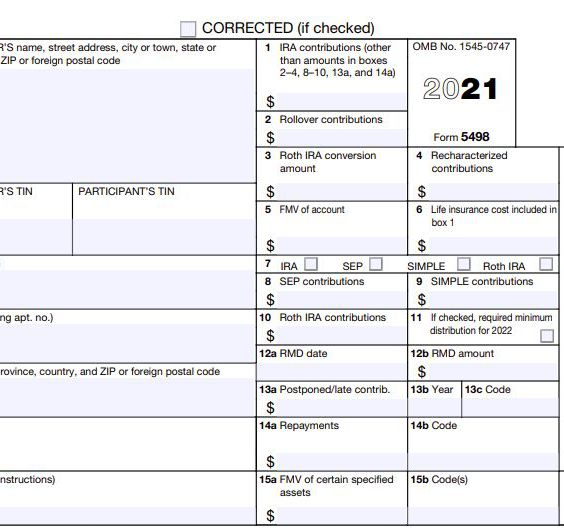

At some point in your lifetime, you will be required to distribute the assets in your pre-tax/tax-deferred retirement account(s) (i.e., Traditional IRA, SEP IRA, SIMPLE IRA). Required Minimum Distributions (RMDs) generally are minimum amounts that a retirement plan owner must withdraw annually starting with the year that they reach age 73.

So, what happens if you have a portion of your retirement dollars invested in precious metals?

You have three options.

It is important to keep in mind when considering the below options that taking the RMD in any form (cash or physical assets) will incur a taxable event and satisfy the RMD.

Option 1: Take an RMD from a different retirement account.

Per IRS regulations, if retirement plan owners have multiple pre-tax/tax-deferred retirement accounts, it does not matter which account the RMD is taken from. As long as the total withdrawn amount equals the amount of the annual RMD, there are two options:

- Take the entire RMD amount from one account.

- Take portions of the RMD across multiple pre-tax/tax-deferred retirement accounts (tax-free ROTH IRA withdrawals do not count).

For example, let’s say you have a Self-Directed Traditional IRA fully invested in precious metals and a Traditional IRA held at a brokerage firm (i.e., Charles Schwab, Fidelity, etc.) invested in stocks, bonds, and mutual funds. You have the option to take your full RMD from the brokerage firm IRA. Stocks, bonds, and mutual funds are typically easier to liquidate than precious metals.

But, what happens if you have invested 100% of your retirement dollars in precious metals?

You have 2 options.

Option 2: Sell the precious metal assets.

Option two involves selling a portion of your precious metals. This is probably the worst-case scenario since you may not be able to recoup the amount you paid for the precious metals – especially if you purchased them within a few years of needing to process an RMD.

Preferred Trust Company clients that wish to liquidate their precious metal assets to take the amount of their RMD in cash must first contact a precious metals dealer. The dealer will negotiate a sale price for the metal and help you complete the Precious Metals Sell Investment Authorization & Direction Form. The precious metals dealer will also provide an invoice for the sale. This form is available to electronically sign in the clients’ online account portal.

Precious metal sales can take a few weeks to process, so it is important to request the sale in advance of the IRS imposed RMD deadline.

The saying continues to ring true today, do not put all your eggs in one basket. Having some liquidity in your IRA account when you have non-income generating investments can make a significant difference between your ability to build your retirement, taking a loss, or potentially disqualifying your IRA account.

You can help mitigate the need to take this course of action by taking full advantage of your Self-Directed IRA. Our Investment Community is a great place to start exploring other alternative investments that have the potential to provide you with a regular source of income and preserve your wealth.

Option 3: Take an in-kind distribution of the metals.

You can take an in-kind distribution (take personal possession) of the metals, but this will cost you. Not only will you incur processing fees assessed by the Self-Directed IRA custodian, but you will be responsible for paying shipping and handling costs for the depository to send your metals to you.

Shipping costs alone can be astronomical (metals are extremely heavy and expensive to insure!). If you have drained the cash in your IRA account, you will not have the funds necessary to pay the shipping costs associated with the investment.

Investment related costs are required by the IRS to be paid by the IRA. However, if you are still working and have an earned income, you do have the option to make a contribution to the IRA account to cover the investment related costs. Otherwise, you will need to sell some metals to create liquidity for the shipping costs.

Preferred Trust Company clients that wish to take personal possession of their precious metal assets must complete the In-Kind Distribution Form. This form is available to electronically sign in the clients’ online account portal.

Work with Your IRA Custodian to Process the RMD

These are great reminders that Precious Metals dealers are not custodians. They have nothing to do with the administration of your IRA. Reaching out to them to assist you in completing documents and forms related to a distribution is not a good idea. You should always contact the custodian directly. Custodians are trained and licensed to help you complete the correct forms and explain all your options.

Important: Self-Directed IRA custodians are not licensed to automatically distribute funds/assets without your specific direction. You are solely responsible for completing the documents to take your annual RMD each year. IRS penalties may apply if you fail to do so. If you are relegated to taking your RMD via option 2 or 3, you must initiate it by completing the corresponding paperwork every year.

For more information about RMDs, take a look at our Q & A for Required Minimum Distributions blog post or listen to the How to Navigate Required Minimum Distributions (RMDs) podcast episode on PTC Point of View: A Retirement Podcast.

Preferred Trust Company staff are available to assist clients Monday through Thursday from 8AM – 5PM PDT and Friday from 8AM – 4:30PM PDT. Please email clientservice@ptcemail.com for assistance.