These are the top 5 questions you should ask yourself when considering digital currency as an investment strategy in your Self-Directed IRA.

Question 1: Should I be leery of digital currency marketers?

As a self-directed IRA custodian, Preferred Trust Company provides clients with the ability to invest in alternative investments through a Self-Directed IRA. The investments allowed are determined by the Internal Revenue Service (IRS). As a self-directed IRA custodian, Preferred Trust Company does not represent itself as anything other than a licensed and regulated Trust Company that holds custody of alternative investments. Custodians are not in the business of selling investments.

Because alternative investment custody services align with alternative investments, we work with independent digital currency brokers that market and sell digital currency to mutual clients. Digital currency dealers do have some clever tactics to drive the purchases of digital currency. Buyer beware, some digital currency brokers represent themselves as being a custodian, going as far as using IRA in the company name and representing that they offer a Bitcoin IRA. Some would say that the company name should not matter, but it does if the sale to follow is deceitful or misleading in nature. For the record, there is no such thing as a Bitcoin IRA. There are two types of IRAs as defined by the IRS, a Traditional IRA and Roth IRA. Yes, there are SEP and SIMPLE IRAs, but they are treated as a Traditional IRA, as a tax-deferred vehicle. Nowhere in the IRS publications are you going to find a Bitcoin IRA.

The saying “your reputation is everything” is how Preferred Trust Company has been able to weed through the deceitful or misleading digital currency brokers in the industry. We do this by requiring an in-take call with all clients to ensure that clients are aware of the roles of the digital currency broker and the self-directed custodian, along with the subsequent fees involved with both parties.

Question 2: Does it matter what trading platform is used for the purchase and sale of digital currency?

Preferred Trust Company strongly encourages clients to conduct their due diligence with every investment prior to the funding of the investment from their IRA. This statement also applies to the selection of the trading platform company that will be the conduit between the digital currency broker buying the digital currency and the transmittal of IRA client funds to complete the purchase and sale transactions.

The trading platform company’s reliability and regulation is of the utmost importance as the IRA client’s funds will be sent to and from the trading platform provider to purchase and sell the digital currency. Not all custodians handle digital currency transactions with a broker the same way. Here is the process at Preferred Trust Company:

- The digital currency broker accesses the trading platform online when consummating the purchase of digital currency with the client.

- The digital currency broker sends the client an investment authorization and direction form to be executed as required by the custodian, and then sends the executed form to the custodian.

- The custodian verifies the purchase and wallet address of digital currency on the trading platform.

- The funds from the client’s IRA are sent to the trading platform, once the funds are received by the trading platform, the trading platform transfers the digital currency to the specified wallet address provided by the custodian.

- The custodian verifies the digital currency was received to the specified wallet, and then informs the client that the digital currency transaction has been completed.

A subsequent sale of digital currency would require the custodian to engage the trading platform provider and contact the client to confirm the agreed upon sale price, and then send the digital currency back to the trading platform with the expectation that a wire representing the agreed upon sales price will be transmitted back to the self-directed custodian and returned in the client’s IRA to consummate the sale.

Since there are hundreds of digital currency trading platform companies cropping up, it makes the selection process that much more important because it can determine whether you receive your digital currency from IRA funds sent or receive your IRA funds back upon selling digital currency.

The goal of Preferred Trust Company is to work with a trading platform that has a lengthy history as an established financial institution and is governed by state and federal regulatory bodies in the United States. The second consideration in the selection process was the trading platforms approach to the allowable digital currency types offered and to lean on the trading platform’s expertise in what types of digital currency they offer based on their risk tolerance. The final consideration was ease of use and information provided based on the technology from the backend to the user interface on the front-end.

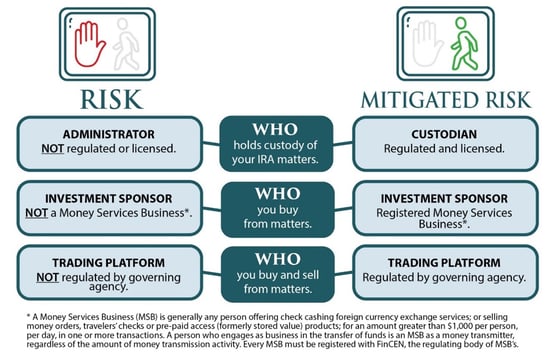

The below chart illustrates some of the criteria you should consider when evaluating the risk of who you work with when adding digital currency as an alternative investment in your self-directed IRA:

To continue reading the next 3 questions, Click Here to download the rest of this whitepaper for FREE.